Suzanne M. Bump, a Massachusetts State Auditor, issued a report in line with the state-owned lands’ (SOL) Commonwealth’s payments in line with taxes (PILOT) program. She noted that the program was underfunded, which gives a grave disadvantage to small rural communities while it favors the wealthier and larger communities.

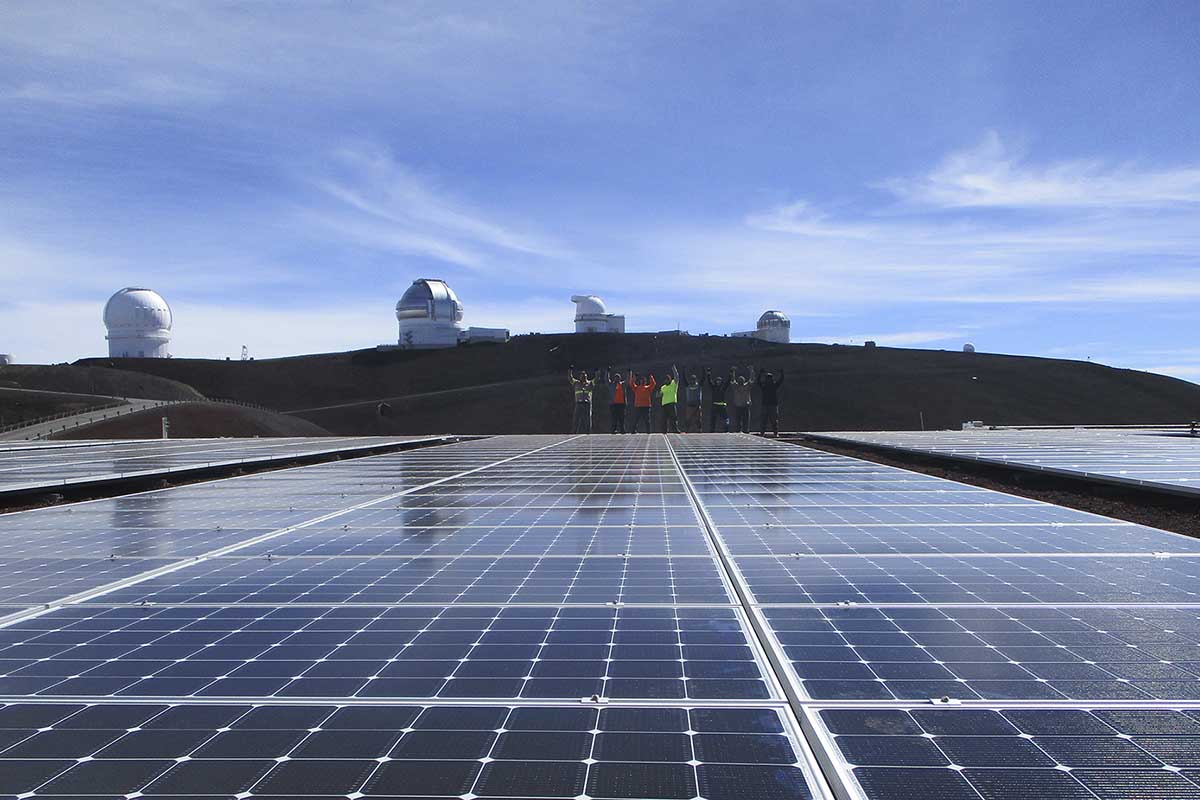

The report also included Bump’s findings of the outdated taxes paid by the solar power generators due to state laws. As a result of this oversight, the adoption of solar innovations has become slower, and it also poses confusion for the solar operators and municipalities.

The PILOT programs were created to make it easier for communities to understand and adopt solar development, but the findings will hamper such a goal. Bump suggested for lawmakers to look into the problem before it gets any worse.

These programs can be efficient if given adequate funding. It can only be done if lawmakers clarify the solar tax exemptions for small commercial and residential installations. They must also implement provisions to protect communities, which property values continue to decline.

The problems were later addressed by Representative Jeffrey Roy and Senator Michael Rodrigues, who both forwarded bills that included the clarifications regarding solar tax exemption.

The Assessor of the Town of Concord, Lane Partridge, said the Bump’s report brings to light the issues that municipalities and local officials face in administering the solar tax exemption law. Partridge agreed that only a legislative change could resolve the problem. The provisions need to be updated following the current municipal practices and technology.